Following the recession in 2008, the Fed has kept interest rates at around zero percent while aiming to reignite a stagnant economy. While it showed some positive signs, the Fed felt it had to do more in order to prevent further economic downturn, engaging in multiple rounds of quantitative easing to further bolster efforts of stimulating the economy. Following more positive economic results and the tapering of QE, investors have speculated over the timing of an inevitable Fed rate hike. Fed chair Janet Yellen has reconfirmed plans to begin the normalization of monetary policy later this year, with a Fed funds rate hike the likely first step.

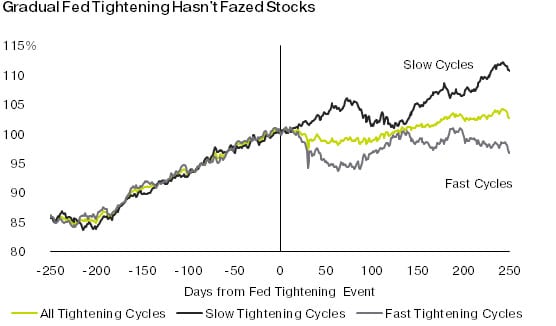

While much of the focus has been on the timing of the Federal Reserve’s tightening, investors should primarily be concerned with the pace of the tightening schedule. Yellen similarly noted that the exact timing of the hike is less important than the outlook of rates over the next several years, giving reason to expect the Fed to raise rates very slowly and gradually. In order to anticipate the market’s reaction to a Fed tightening, we can look back at other instances of rate increases for some guidance.

Investors typically worry that a Fed tightening will negatively impact the financial markets. However, looking back at the most recent rate hikes suggest that this change in monetary policy will not signal the end of the current bull market. Initially, the shock of the policy change is reflected with negative returns from the S&P 500 in the first few months; however history suggests that stocks will return to generating positive returns six to twelve months following the first increase in the Federal funds rate.

In addition to the fact that equity returns have generally responded favorably to Fed rate increases, the anticipated pace of this increase gives us further reason to expect stocks to weather the normalization process. As noted above, all indications from Yellen have pointed to the Fed raising rates at a glacial pace. This bodes well for the equity market. In periods of gradual Fed tightening, equities show an average gain of 10.8% in the year following the first rate increase, compared to a measly 2.9% increase in typical tightening schedules. Still, investors should fear fast rate increases as the S&P index lost an average of 2.8% in the year following a rate lift-off. However, given Yellen’s comments about the large scope of rate increases, we should expect a slow and gradual movement of rates.

Source: Ned Davis Research, 5/12/15. Slow cases include: 4/25/46, 4/15/55, 9/12/58, 7/17/63 and 8/31/77. Fast cases include: 11/20/67, 1/15/73, 9/26/80, 9/4/87, 2/4/94, 6/30/99 and 6/30/04.

Rather than viewing the onset of Fed normalization policy as a negative, investors should see it as a concrete sign of an economy with a healthier footing. If we are correct in viewing this as a gradual highly accommodative increase, as Yellen has described, then stocks should be considered a safe investment despite investor fears. Moving forward, investors should not be concerned about speculating when this rate hike may begin, but should continue to be wary of overall pace of the normalization.

The opinions expressed in this material do not necessarily reflect the views of LPL Financial.